A dealer friend recently commented, “It’s been too easy, and we have developed some bad habits in our sales department over two years.” It’s understandable how it can happen, but let’s address this sooner rather than later.

The 15 years I spent in an ag equipment dealer sales department were full of challenges and opportunities. However, the most satisfaction was derived from when sales opportunities were not easy… every sales opportunity needed our best effort, and the details mattered. While the margin wasn’t always the best, we found victory in converting sales opportunities. It may be worthwhile to review what it is that differentiates your dealership and its products versus the competition. Merely having the right piece of equipment is not going to be enough. We need to renew our “for better or worse” vows and be prepared for a set of challenges that we haven’t seen for a while, nor have many experienced in our time in the dealership.

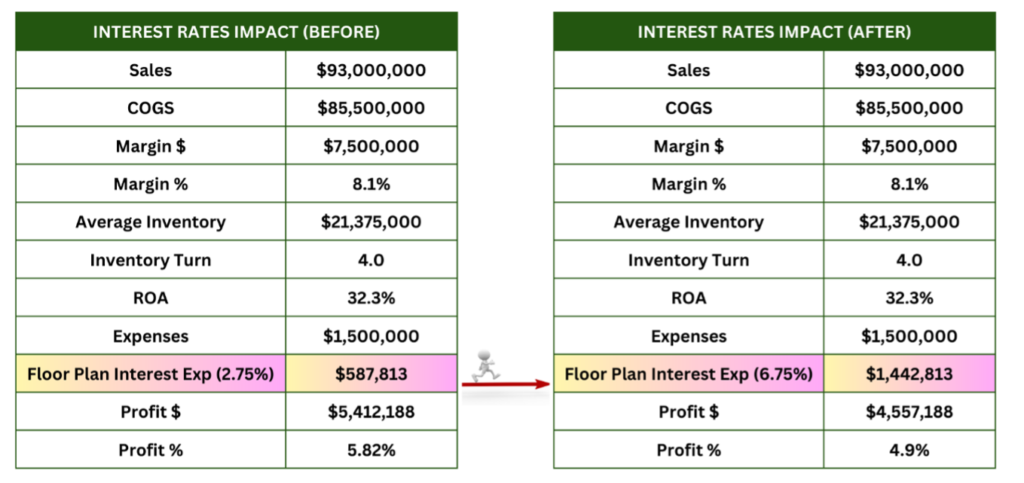

Interest Rate Implications

It might feel like we are experiencing one of those warm, humid summer days where the weather is enjoyable, but we aren’t certain if a storm could brew up. We don’t know exactly what might happen, but we have some factors that should put us on alert.

While still historically low, we haven’t had these kinds of interest rates since late 2006 and early 2007. The spike in interest rates that occurred then was very short-term. We are likely to see more sustained rates. A lot of industry professionals on dealer management teams have never had the challenge of interest rates on financing equipment being sustained over 6%. My unofficial dealer poll finds floor plan interest rates ranging from 6.5% to 7%.

Additionally, it is important to acknowledge that certain retail finance “tools” for moving through some of the used equipment may not be available like it was from 2013 through 2015. For example, ultra-low interest loans and low lease rates were great tools to use back then. They are not likely to be available to our industry to the same extent this go around. We will keep that in mind, but for the exercise below, we will focus on the implications of 2.75% vs. 6.75% interest-carrying costs for the dealership, assuming everything else being equal.

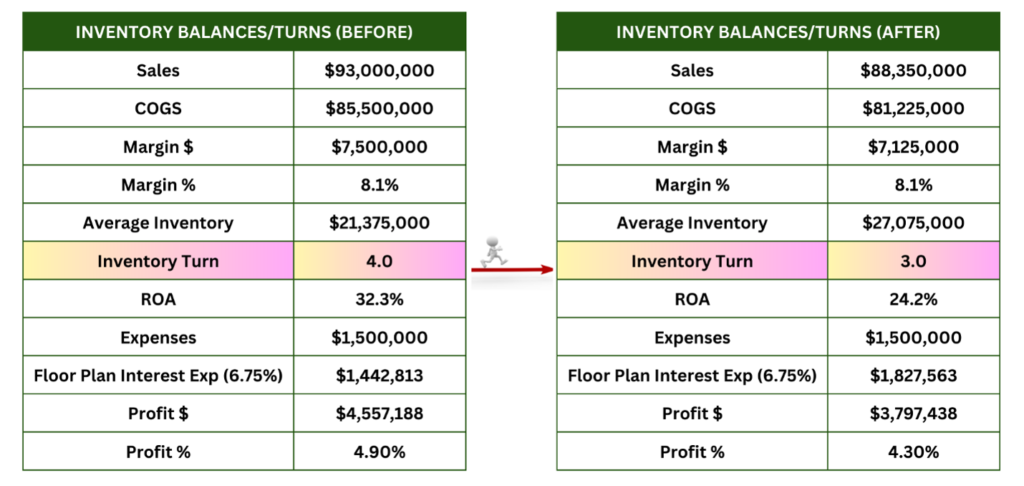

Used Equipment Turns

We used to joke about needing to focus on the “trend-setting” operators to get them to buy used equipment. If we could get them on board, we knew the neighbors were watching and it would not take them long to get on board as soon as we got Mr. Trend Setter to bite. Unfortunately, the reverse can be true too. As soon as Mr. Trend Setter goes into lockdown mode, it seems like the others do too. Realizing, of course, that these equipment buyers were likely facing the same economic factors influencing their decision-making, I believe there is merit to the theory. Regardless, Mr. Trend Setter seems to be cooling off on equipment investments and inventories are slowly starting to climb in a lot of market segments. In the exercise below, we’ve now added in the potential for used equipment turns to slow down by means of inventory balances creeping up and sales softening, assuming, for now, everything else, including margin, stays equal.

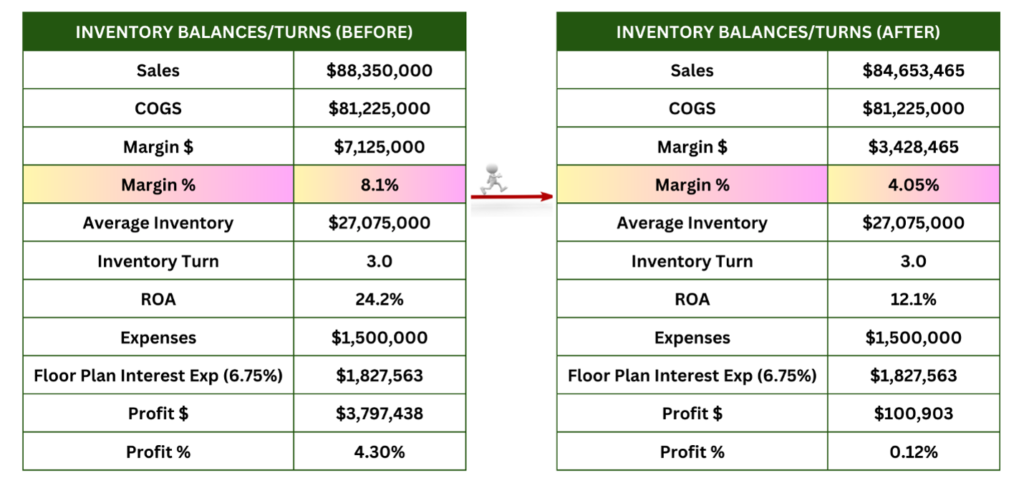

Declining Values

We can be thankful our industry is one that doesn’t accumulate inventory overnight. The bad news is that dealers have likely committed to trades that won’t become available and are on the books for 6 to 12 months. It certainly could stay strong or even improve, but the sentiment seems to be that we are more likely to see equipment values soften. The nature and extent of that change is to be determined, but a 10% decline in used equipment value is not a small amount of money. Dealer balance sheets are in good shape, but it does not mean it will be fun. If the inventory starts to grow and/or values start to soften, it is not likely to cure itself overnight either. For this exercise, let’s add in the potential for margin going from 8.1% to 4.05%, where we’re now selling the same amount of equipment (COGS) at a lesser margin.

*Some may do a cost adjustment to write their inventory down or take other actions. In the end, the concept is the same. Values/Margins could decline, with an impact to the bottom line.